9/25/25 ECEA Members ONLY Child Care Update

Responsibly Deregulating Child Care: A Necessary Step to Ensure the Survival and Safety of Our Programs

The child care industry is in crisis, with programs closing and families losing access to reliable care. Overregulation, while well-intentioned, is driving up costs and pushing providers out of business. To ensure the survival of child care programs and maintain child safety, some degree of deregulation is urgently needed.

The Burden of Over-Regulation

Child care centers are among the most heavily regulated industries in the United States. While regulations aimed at promoting safety and quality care are crucial, many of these rules are outdated, unnecessarily complex, and disproportionately affect small businesses. Child care providers are required to comply with a maze of state, local, and federal requirements, ranging from staff-to-child ratios to detailed physical space standards. Many of these requirements, although well-intentioned, create significant barriers for programs, especially those serving lower-income communities.

In an environment where child care providers are already operating on thin margins — facing challenges such as rising wages, property taxes, and insurance costs — the added administrative burden is often too much to bear. Many providers are forced to close their doors or operate at reduced capacity, ultimately leaving fewer options for families in need of care. For-profit and nonprofit providers alike find themselves struggling to stay afloat, despite their best efforts to ensure a safe, nurturing environment for children. This is especially difficult when they find that they are now competing with publicly funded school districts who are enrolling 3 year olds as loss leaders to secure UPK funding from the family the following year.

High-quality child care requires elements like lower staff-to-child ratios, well-compensated and trained educators, developmentally appropriate curricula, safe environments, and family engagement—all of which drive up operational expenses per child. For example, smaller ratios mean more staff per group, increasing payroll, while competitive wages and benefits are needed to retain skilled workers, adding to labor costs that often account for 60-80% of a program's budget. As shown in a cost analysis by the Hunt Institute (referencing Table IV on true cost modeling), the true cost of care at higher quality standards is significantly above lower-quality benchmarks and state averages for infant care, directly inflating per-child expenses. Their chart on page 24, if you do the math shows the cost average cost increase for high quality:

Infant (0-12 months) - $7,853

Toddler (1 year old) - $8,498

Toddler (2 year old) - $8,498

3 year old - $3,408

4 year old - $2,260

TOTAL fiscal impact for families over a 5 year range of services: $30,517 (if averaged is $6,103 more a year per child in cost for care).

This undermines affordability, as providers must either raise tuition (pricing out families) or absorb losses, leading to financial strain, closures, or reduced quality—evident in page 24's Table III, where child care rivals housing as a core household expense, ranging from $1,009 to $2,261 monthly for a two-child family across U.S. counties. Without sufficient public funding to bridge this gap these quality improvements paradoxically make care less accessible. This is how you break an industry.

The Case for Child Safety Through Flexibility

Deregulation does not mean compromising child safety.

Rather, it means prioritizing child safety through a more flexible, common-sense approach. Regulations that place unnecessary restrictions on child care providers — such as overly rigid space requirements or excessive paperwork — take valuable time and resources away from the core mission of child care programs: ensuring the well-being of the children in their care.

The safety of children is not dependent solely on the number of square feet per child or mandating a decrease in staff-to-child ratios. In Colorado, for example, research was used to support a reduction in staff-to-child ratios for the UPK program, despite the study explicitly stating it could not be used to justify changes to ratio requirements. Despite significant public opposition and an absence of evidence showing current ratios compromise child safety, the Colorado Department of Early Childhood (CDEC) is proceeding with plans to lower Universal Pre-K (UPK) ratios to 1:11 by July 2026 and 1:10 by July 2027. Flexibility in regulations would allow programs to focus on what truly matters: creating safe, nurturing environments where children can learn, grow, and thrive.

Protecting the Future of the Industry

Without responsible deregulation, the child care industry risks collapse. Rising insurance and staffing costs, driven by regulatory compliance, threaten financial viability. April data shows that currently 2 out of 3 community based programs in Colorado are operating below profitable levels. A Business cannot sustain when they cannot operate at a profitable level because they are not positioned then to replace failing equipment, or other items as needed. They are burning through any reserves that they have just to sustain their business. If programs continue to close, families will lose access to quality care, and providers may cut corners, potentially compromising safety. Sensible deregulation can ensure programs remain open and financially sustainable while maintaining high safety standards.

A Call to Action

Responsible deregulation in the child care industry isn’t just an economic necessity — it’s a matter of child safety and future stability. Advocates, policymakers, and families must work together to rethink our current regulatory framework, finding a balance between safety and flexibility that allows child care providers to operate successfully. By supporting sensible deregulation, we ensure that child care programs remain open, that children are cared for in safe, loving environments, and that workers are paid what they deserve and can stabilize insurance costs for programs.

Did you know....? Revisiting basic tax information for businesses. Make sure you've checked all of the boxes so that you can get the full benefit of tax law.

Child care business owners, such as those running home-based daycares or larger centers, can take advantage of several IRS tax benefits to reduce their taxable income. These primarily come in the form of deductions for business-related expenses, with some special rules for home-based operations. While there aren't many targeted tax credits specifically for child care providers (unlike the Child and Dependent Care Credit, which is for parents paying for care), the deductions can be substantial if properly documented. Below is a list of key ones to be aware of, based on IRS guidelines and resources. Always consult a tax professional for your specific situation, as rules can depend on whether your business is home-based, licensed, or structured as a sole proprietorship, LLC, etc.

1. Business Use of Home Deduction

If you operate your child care business from your home (e.g., family day care), you can deduct a portion of home-related expenses like mortgage interest, rent, utilities, insurance, repairs, property taxes, and depreciation. This doesn't require exclusive use of the space for business, as long as it's regularly used for day care and you meet state licensing requirements (or are exempt).

- How it works: Calculate based on the percentage of your home's square footage used for business, adjusted for the time it's used (e.g., business hours vs. total hours available). Direct expenses (e.g., repairs just in the day care area) are fully deductible; indirect ones (e.g., whole-home utilities) are prorated.

- Simplified option: Multiply up to 300 square feet by $5 per square foot (up to $1,500 max), prorated for non-exclusive or part-year use—no need to track actual expenses.

- Tip: Deduction is limited to your business's gross income minus other expenses; carry over excess to future years.

2. Food and Meal Expenses

Deduct the cost of meals and snacks provided to children in your care—this is a big one for child care providers, as it's fully deductible (no 50% limit like other business meals).

- How it works: Use actual costs (with receipts) or IRS standard rates (e.g., $1.65 for breakfast, $3.12 for lunch/dinner, $0.93 for snacks in most states; higher in Alaska/Hawaii). Non-food items like plates or utensils are also deductible.

- Reimbursements: If you participate in programs like the Child and Adult Care Food Program (CACFP), report reimbursements as income but deduct expenses fully—net excess as income.

- Tip: Keep daily logs of attendance, meals served, and children's names. Family meals aren't deductible.

3. Supplies and Equipment Deduction

Deduct costs for toys, educational materials, furniture, playground equipment, safety items, and other supplies used in the business.

- How it works: Small items are fully deductible in the year purchased; larger ones (over $2,500) may be depreciated over time or expensed under Section 179 (up to certain limits, like immediate expensing for qualifying property).

- Tip: Track receipts and business use percentage if items have personal use.

4. Vehicle and Mileage Expenses

If you use your vehicle for business (e.g., field trips, picking up supplies, or transporting kids), deduct related costs.

- How it works: Choose actual expenses (gas, maintenance, insurance, depreciation) or the standard mileage rate (e.g., 67 cents per mile in 2025—check IRS for updates). Only business miles count.

- Tip: Maintain a mileage log with dates, purposes, and odometer readings; strict substantiation required.

5. Depreciation of Assets

For long-term assets like equipment, vehicles, or home improvements, deduct a portion of the cost each year over the asset's useful life.

- How it works: Use IRS depreciation tables (e.g., MACRS). Bonus depreciation or Section 179 can accelerate this for faster write-offs.

- Tip: Applies to business-use portion only; basis is cost or fair market value if converted from personal use.

6. Start-Up and Organizational Costs

Deduct up to $5,000 in the first year for costs to start your child care business (e.g., licensing fees, advertising, inspections, legal fees), with the rest amortized over 15 years (if total under $50,000).

- Tip: Election is automatic unless you choose otherwise; keep records from before opening.

7. Training and Professional Development

Deduct costs for workshops, certifications, conferences, or courses related to child care (e.g., CPR training, early childhood education).

- How it works: Includes fees, materials, and travel; must improve skills in your current business.

- Tip: Personal education (e.g., unrelated degrees) doesn't qualify.

8. Insurance Premiums

Deduct business-related insurance like liability, property, or health coverage for employees (or yourself if self-employed).

- Tip: Prorate for business use if covering personal aspects.

9. Advertising and Marketing

Deduct costs for promoting your business, such as flyers, website fees, online ads, or business cards.

- Tip: Fully deductible if ordinary and necessary.

10. Licenses, Permits, and Professional Services

Deduct fees for state-required licenses, certifications, background checks, legal advice, or accounting services.

- Tip: Renewals count too; essential for compliance.

11. Employee Wages and Benefits

If you have staff, deduct salaries, bonuses, payroll taxes, health insurance, retirement contributions, and other benefits.

- Tip: Report on Schedule C; self-employment taxes apply if you're the owner.

12. Other Potential Credits (If Applicable)

- Employer-Provided Childcare Credit: If your child care business provides on-site care or subsidies for your employees' child care (not clients), you may qualify for a credit up to 25% of qualified expenses, plus 10% for resource/referral services (max $150,000 per year). This is more common for larger centers.

- Child Care Tax Contribution Credit: This is a state income tax credit for taxpayers who make monetary donations to licensed Colorado child care facilities or programs. The credit is equal to 50% of the total qualifying contribution. Reach out to Dawn if you need to learn more.

- Research and Development Credit: Rare, but if you invest in innovative curricula or programs, it could apply to reduce tax liability.

Recordkeeping is crucial—use logs, receipts, and software to substantiate everything, as child care providers are often audited. File on Schedule C (Form 1040) for sole proprietors. For the latest rates and rules, check IRS Publication 587 (Business Use of Your Home) and the Child Care Provider Audit Technique Guide.

UPK providers - If you haven't read this you need to!

NEW Workforce Data Dashboard Operational.

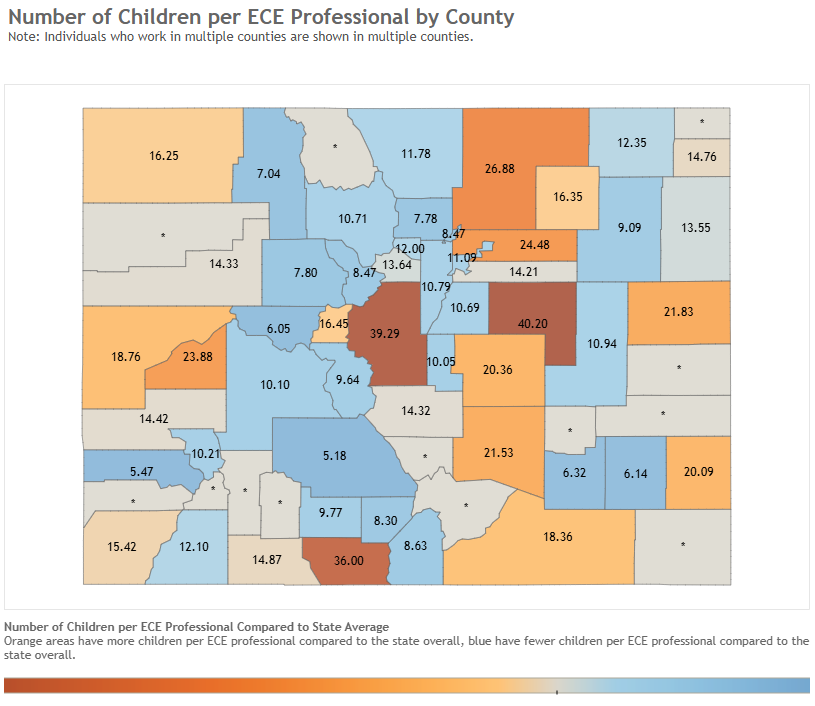

First finding: CO has 3,391 more ECEA Professionals than we did in 2021.

Compare the data to see what you can learn:

Check you systems to make sure this won't negatively affect you.

- Colorado appeals ruling allowing taxpayer-funded preschool to discriminate

- Child care providers in Minnesota want to change strict rules

- Child Care Modernization Act (Federal) Summary

- Parents accuse school district employees of giving students 'sleep aid' stickers

-

Colorado lawmakers outlawed some apartment fees. Now small businesses want protections, too.

- State Rep. Jarvis Caldwell elected to lead CO House Republicans

To share with families:

-

This is why birth to 5 is a uniquely critical time for brain development in kids

- More Colorado kids sought mental health support this summer than in past years