8/28/25 Members ONLY Update

Where Advocacy Becomes Challenging

We know that localities are working on tax initiatives that are working to increase taxes to support the industry. Some mountain regions have implemented these tax bases. Larimer County is currently working towards that as well.

The ECEA board will work on policy stances for these increases. When our members met to discuss the possibility of a $400-600 million statewide ballot initiative to increase state taxes to support the child care system the overwhelming concensus was that this is likely to be UPK 2.0 and would ultimately kill the industry for community based care.

We are VERY aware that some of our members are looking towards local tax increases to save their programs. We want solutions. There is NO doubt about that! The struggle and the strain is in whether a local or statewide tax is ultimately the right solution. We see headlines that say: "... County asking voters for sales tax for child care" and in part think YES! Also in part we think: "...County offers tax payers the opportunity to help pay for other peoples child care for the next 20 years." Perhaps the solution lies in the portion of the state budget that funds public schools versus what funds community based child care. Perhaps there are better policy solutions that we haven't approached. We are asking members to help us think through the tension points of the policy work that we need to do to make a diffference in the industry. If you have ideas...please let us know!

Go to our FAQ page in the new members only website to find out how you can use CareerPlug too! It's only $60 a month for Pro level members and $70 a month for Plus level members. Jobs post quickly on 10 major job boards and on ECEA's website as well: https://www.coloradoecea.org/job-board

ECEA Will Provide Parent Referrals for Enrollments too! (NEW)

We need as many members as possible to tell us about their availability through this google form:

Once we've gathered that information for your locations we will share a link to a parent survey tool and push out referrals once a day to those families. We will share it out through social media and will ask you to share it out as well. Together we can make a difference!!

Did you notice...? ECEA is solving the TWO TOP PROBLEMS!!

Need MORE enrollment faster? We have a partner that is making a HUGE difference for programs!!

Use this landing page to schedule a meeting with them to find out more:

https://ccca.partners.marketing360.com/

They use a multi-faceted approach to marketing YOUR business and it generally costs what ONE CHILD CARE SLOT is for your child care business a month. Not sure? One of our members started working with them less than 3 months ago and have gotten 30 NEW CHILDREN ENROLLED in 3 months time! That is $10,500 more a week or $546,000 more a year in revenue. While we could refer non-members there we are NOT! YOU get exclusive support that can transform your business. Schedule with them and see!! Just don't let them drive up your ad costs. Tell them you need a stable budget to work from.

CCCAP News

The federal government has asked CO to resubmit their waiver in a new template system. CO will be prioritized (need a response prior to October 1 before IT work is required to launch) and their waiver request is being used as the example of how to make the request as an interim solution prior to the rescinscion of the federal rules.

What we learned this week....another critical part of why CCCAP is on a freeze is because 13 counties overspent their CCCAP budgets by a total of $20,782,219 and the counties that underspent had their funds applied to solve for the overspending of other counties. State reps say that this is the usual process because it is extremely difficult to project out expenditures because families once authorized, remain authorized for an extended period of time.

-

Total FY 24-25 CCCAP Budget: $192,156,002

-

FY 24-25 Base CCCAP Allocation: $177,156,002

-

FY 24-25 CCCAP Supplemental: $15,000,000

-

Final FY 24-25 CCCAP Expenditures: $190,567,805

You might ask, how is it that CCCAP spent $190.5 million and so many programs are struggling with enrollments because of the freezes. We've asked CDEC for some Cost per child comparisons for recent years.

- The federal audit that drove up rates from under 25% to above 75% is driving up the cost per child for care.

- Many of the new CCCAP requirements (from last years new CCDF rules) are not in effect yet. Those are the ones that the feds said they will be rescinding. Many localities have still gone on freeze lists in anticipation of those costs.

- As soon as the state hears on the Waiver request we will reach out to you to let you know what action you can take locally to push them to start supporting families and programs again via CCCAP.

Boulder County Property Valuations - on the rise.

We are doing quick survey for Boulder County for those that OWN their child care program. One program reached out yesterday with an increased valuation of $1.1 MILLION in one years time. That means significant property tax increases.

First Business Insurance Increases. Now Health Insurance Increases.

Health Insurance Marketplace premiums are projected to increase by 18–75% in 2026, based on various analyses. The premium tax credits, which have helped offset costs for many enrollees, were introduced through the American Rescue Plan Act (ARPA), signed into law on March 11, 2021, to address economic challenges during the COVID-19 pandemic. These credits were extended through 2025 by subsequent legislation but are set to be reduced or phased out under new federal policies, contributing to the projected premium increases. The ARPA subsidies were designed as temporary measures to provide relief during the pandemic, and their reduction reflects a shift back to pre-2021 subsidy levels.

In Colorado, the state’s reinsurance program helps cover high-cost claims, which can lower premiums for some plans. However, this program is funded through state resources, which include taxpayer contributions, to manage insurance cost overages.

In 2027 they rates will increase again due to the state laws that were passed last legislative season.

| Bill | Description | Estimated Premium Impact |

|---|---|---|

| SB25-048 | Mandates coverage for obesity/prediabetes treatments | $18–$24 per month per covered person (roughly 4–5% based on average individual premiums of ~$500/month) |

| HB25-1309 | Mandates coverage for gender-affirming care | Less than 1% (based on analyses of similar mandates in other states; exact Colorado figure not specified in sources) |

| SB25-296 | Mandates no cost-sharing for diagnostic/supplemental breast exams | Less than 1% (expands existing preventive care rules; fiscal notes indicate minor cost shifts to insurers) |

Overall, the combined impact of the three bills could add approximately 5–7% to premiums starting in 2027, but they have no effect on current or next-year predictions.

For business, this means more of your employees are going to be looking for financial support for health benefits.

We asked Grok for a hypothetical breakdown of insurance for a small child care center to share:

Quantitative Illustration (Hypothetical)

While exact figures for child care employers are not provided in the sources, consider a small child care center with 10 employees:

- Current Premiums: If each employee’s ACA Marketplace silver plan costs ~$113/month (2024 average), the total annual cost (if employer-subsidized) is ~$13,560.

- Post-2026 Increase: A 75% out-of-pocket increase could raise monthly premiums to ~$197.75/employee, or ~$23,730 annually, a $10,170 increase. For a center with a $500,000 annual budget, this represents a ~2% budget increase, significant given tight margins.

- Employee Impact: If costs are passed to workers earning ~$30,000/year, a $84.75/month increase (~$1,017/year) is ~3.4% of their income, potentially unaffordable.

We also asked Grok for the fiscal impacts on a LARGE Employer. The explanation is extensive and doesn't apply to some of our members. That is posted in our community page under Centers if you are interested! (Scheduled to post on 8/28 at 10 a.m.).

Speaking of Supporting Workforce

We wanted to remind you that if you provide your employees with a badge it is very likely that they can save money! Most teacher discounts only require a badge to utilize a teacher discount. We worked with 4 other states to find out if benefits were available for early childhood teachers. Most companies resonded that they are with a badge. Share this with your staff so that they can start saving!

State Leadership Calls for Collaboration but Faces Challenges in Bipartisanship

While there is significant focus on federal-level legislative approaches, Colorado’s state legislature encounters similar challenges in fostering bipartisan cooperation. During the recent special session, only two bills sponsored by Democrats included a Republican co-sponsor, and no Republican-sponsored bills had a Democrat co-sponsor. Our organization tracks these dynamics to inform our lobbying efforts, identifying which legislators collaborate across party lines to advance policies for Colorado residents. Updates to our Legislative Trackers help us maintain awareness of these relationships, regardless of which party holds the majority. Here is the Legislative Tracker for the special session: https://docs.google.com/document/d/1_9TPp4PGXj4twvu57qmTUil3D4ZymLjJ4E0xPKlXDCs/edit?usp=sharing

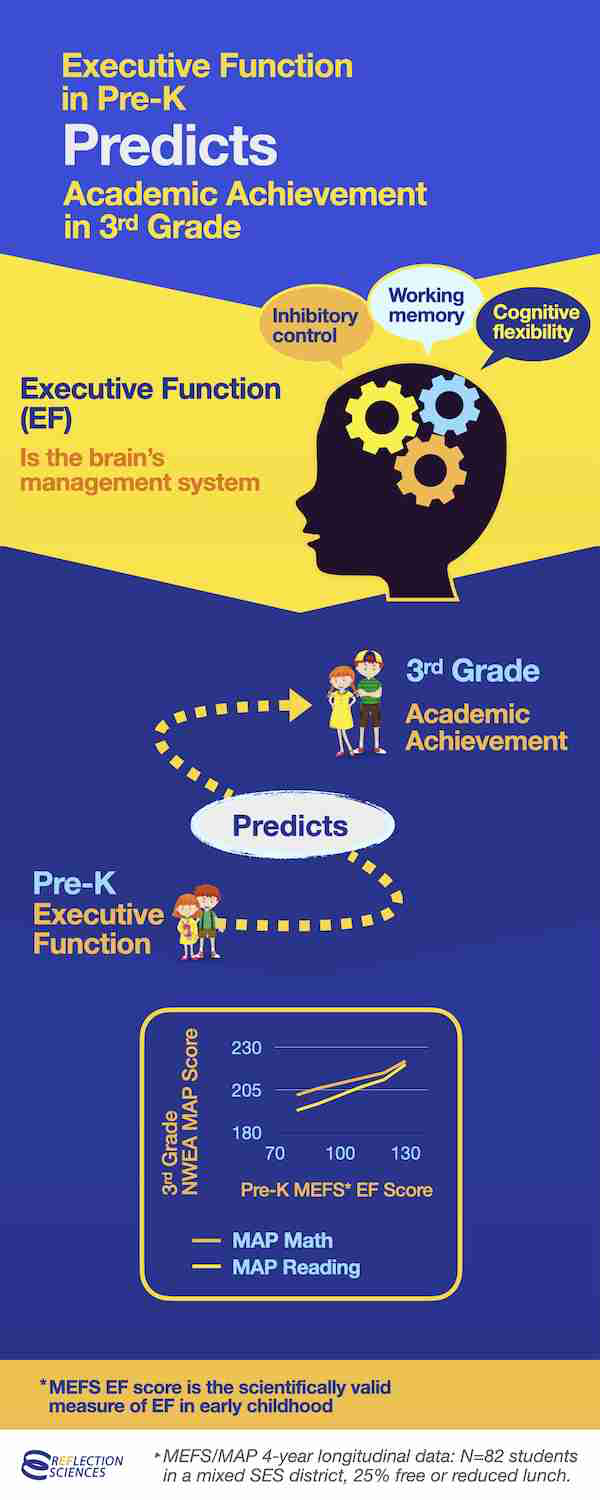

ECEA Bright Foundation partners with Reflection Sciences to bring the best rates in the nation to Colorado for their Executive Function (EFgo™).

Save $5 per child for the assessment that is backed by four PAGES of research. Parents get access to the assessments and get Executive Function Support ideas on how to increase the development in their child's EF development. Cost? $20 a year for unlimited assessments. CO Family Child Care Homes had this to say about the assessment from last year:

- "It allowed me to adjust my teaching to meet their individual needs."

- "Now they excel in the skills that were missing."

- "Showed their Executive Function Growth and helped me with planning."

- "Helped communicate with families what I’m focusing on as an educator and what resources they can utilize to better serve their child’s development."

CDEC Independent Evaluation Team Changing.

The organization PCG) that was conducting hte evaluation had some misses....pushed out partial data in open public meetings that didn't take CDEC data into consideration, were expanding the evaluation above what statutute required. They are being replaced by Child Trends and Watershed to take possession of the data and proceed with the report that is due to the state legislature 8 weeks from today.

Family Fun Fair

1st year numbers include: More than 450 attendees and 55 vendors!

Check out some of our photos here: https://www.coloradoecea.org/2025-event-photos

Are YOU Struggling Financially?

Schedule a time to meet with us to consider some business pivots that will:

1) SAVE you money (upwards of $100,000 a year)

2) Increase your enrollment (increasing revenue around $400,000 a year.

Your membership makes a difference!! THANK YOU for being a member!!